James Mucci's Email & Phone Number

President and MLO (NMLS #138693) at Treeside LLC dba Treeside Financial (NMLS # 138594)

James Mucci Email Addresses

James Mucci's Work Experience

Treeside Financial (NMLS # 138594)

President and Mortgage Loan Originator (NMLS #138693)

January 2020 to Present

E2 Lending Elevate Your Mortgage Experience

Account Executive

March 2019 to January 2020

Account Executive (Wholesale and Non Delegated Correspondent)

February 2017 to March 2019

ClearVision Funding

Account Executive - Wholesale & Correspondent Mortgage Lending

October 2013 to November 2014

ClearVision Funding

Regional Sales Manager

October 2013 to November 2014

Sierra Pacific Mortgage

Wholesale Mortgage Lender - Account Executive

January 2011 to October 2013

Treeside Financial, LLC

President/Owner

April 2007 to January 2011

Cranbrook Mortgage

Vice President

June 2001 to April 2007

Show more

Show less

James Mucci's Education

University of Northwestern Ohio

Macomb Community College

Show more

Show less

Frequently Asked Questions about James Mucci

What is James Mucci email address?

Email James Mucci at [email protected] and [email protected]. This email is the most updated James Mucci's email found in 2024.

What is James Mucci phone number?

James Mucci phone number is 586-504-2036, 586-350-9741 and +1.5866480021.

How to contact James Mucci?

To contact James Mucci send an email to [email protected] or [email protected]. If you want to call James Mucci try calling on 586-504-2036, 586-350-9741 and +1.5866480021.

What company does James Mucci work for?

James Mucci works for Treeside Financial (NMLS # 138594)

What is James Mucci's role at Treeside Financial (NMLS # 138594)?

James Mucci is President and Mortgage Loan Originator (NMLS #138693)

What industry does James Mucci work in?

James Mucci works in the Financial Services industry.

James Mucci's Professional Skills Radar Chart

Based on our findings, James Mucci is ...

What's on James Mucci's mind?

Based on our findings, James Mucci is ...

James Mucci's Estimated Salary Range

James Mucci Email Addresses

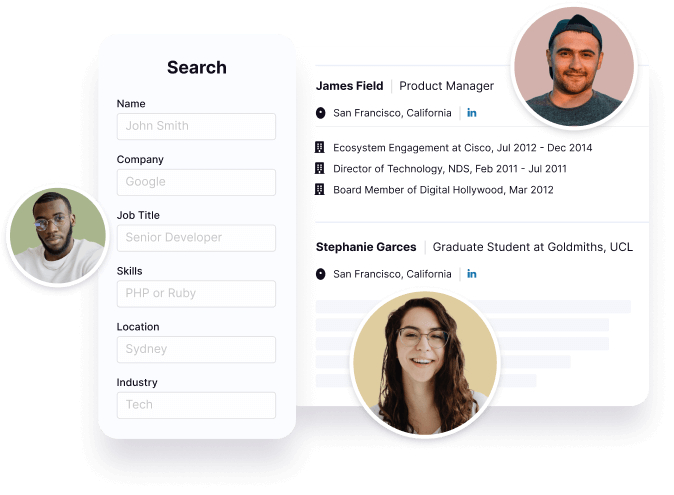

Find emails and phone numbers for 300M professionals.

Search by name, job titles, seniority, skills, location, company name, industry, company size, revenue, and other 20+ data points to reach the right people you need. Get triple-verified contact details in one-click.In a nutshell

James Mucci's Ranking

Ranked #330 out of 6,592 for President and Mortgage Loan Originator (NMLS #138693) in Michigan

James Mucci's Personality Type

Extraversion (E), Sensing (S), Feeling (F), Judging (J)

Average Tenure

2 year(s), 0 month(s)

James Mucci's Willingness to Change Jobs

Unlikely

Likely

Open to opportunity?

There's 88% chance that James Mucci is seeking for new opportunities

James Mucci's Social Media Links

/in/jamesmucci /school/macomb-community-college/ /company/treeside-financial