Eugene Fama's Email & Phone Number

American economist

Eugene Fama's Email Addresses

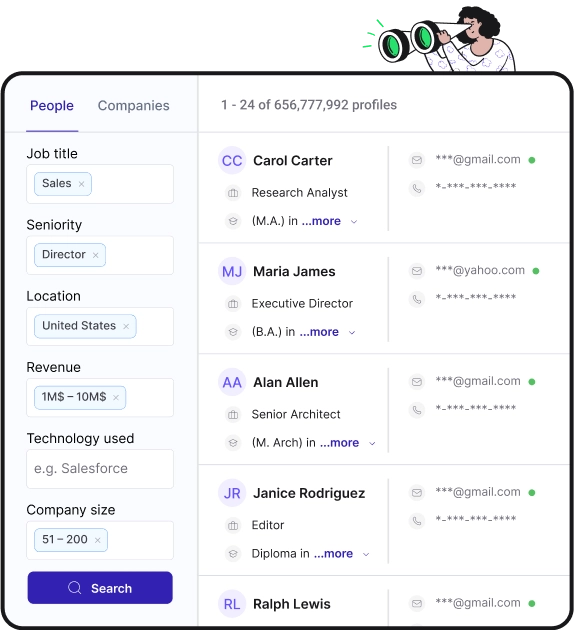

Find personal and work emails for over 300M professionals

Not the Eugene Fama you were looking for? Continue your search below:About Eugene Fama

📖 Summary

Eugene Fama is an American economist renowned for his groundbreaking work in the field of finance. Born on February 14, 1939, in Boston, Massachusetts, Fama is widely regarded as one of the most influential economists of his time. He is best known for his work on market efficiency and the efficient-market hypothesis, which has had a profound impact on the way finance is understood and practiced.

Fama received his Bachelor's degree in Romance Languages from Tufts University in 1960 and then went on to earn his MBA and PhD in economics from the University of Chicago in 1963 and 1964, respectively. He joined the faculty at the University of Chicago in 1963 and has spent his entire academic career there, eventually becoming the Robert R. McCormick Distinguished Service Professor of Finance in 1995.

Fama's work on the efficient-market hypothesis, which he first proposed in the 1960s, has had a profound impact on the field of finance. The efficient-market hypothesis suggests that financial markets are efficient in reflecting all available information, which means that it is impossible to consistently outperform the market through stock picking or market timing. This hypothesis has had far-reaching implications for the investment industry and has influenced the development of index funds and passive investing strategies.

Fama's research on market efficiency has earned him numerous accolades and awards, including the Nobel Prize in Economic Sciences in 2013, which he shared with Robert Shiller and Lars Peter Hansen. The Nobel committee recognized Fama for his "empirical analysis of asset prices," highlighting the impact of his work on the understanding of market pricing and the behavior of stock prices.

In addition to his work on the efficient-market hypothesis, Fama has made significant contributions to the field of finance through his research on the relationship between risk and return. His research has provided important insights into the factors that drive stock prices and has helped to inform investment strategies and portfolio management techniques.

Fama's influence extends beyond academia, as his research has had a major impact on the practice of finance and investment management. His work has helped to shape the way that financial professionals understand and approach the markets, and has had a lasting impact on the development of investment strategies and the management of investment portfolios.

In addition to his academic and research contributions, Fama has also been a significant figure in the financial industry through his involvement with Dimensional Fund Advisors, a global investment firm that applies Fama's research to create investment strategies and portfolios for clients. Fama's partnership with Dimensional Fund Advisors has helped to bring his research findings to the real world and has had a significant impact on the investment industry.

In conclusion, Eugene Fama is a highly influential economist whose work has had a profound impact on the field of finance. His research on market efficiency and the relationship between risk and return has reshaped the way that finance is understood and practiced. Fama's contributions have earned him numerous accolades and awards, including the Nobel Prize in Economic Sciences, and his work continues to have a lasting impact on the practice of finance and investment management.

Frequently Asked Questions about Eugene Fama

What is Eugene Fama known for?

Fama is a prolific author, having written two books and published more than 100 articles in academic journals. He is among the most cited researchers in economics. In addition to the Nobel Prize in Economic Sciences, Fama was the first elected fellow of the American Finance Association in 2001.

What is the philosophy of Eugene Fama?

Fama defined a market to be “informationally efficient” if prices at each moment incorporate all available information about future values. Informational efficiency is a natural consequence of competition, relatively free entry, and low costs of information.

Who is the father of EMH?

Fama is most often thought of as the father of the efficient-market hypothesis, which began with his PhD thesis.

Who won Nobel Prize for efficient-market hypothesis?

Fama, (born February 14, 1939, Boston, Massachusetts, U.S.), American economist who, with Lars P. Hansen and Robert J. Shiller, was awarded the 2013 Nobel Prize for Economics for his contributions to the development of the efficient-market hypothesis and the empirical analysis of asset prices.

Eugene Fama's Email Addresses

People you may be

interested in

Indian actress and director

Film producer

American actor and motorsports racing driver

Football quarterback

Musician

British former professional wrestler

Filipino actor

American author

English internet personality

Canadian actor

Writer

Spanish host and comedian