Tasnim Mushtaq's Email & Phone Number

CFO / Director / Entrepreneur and Interim Management Consultant (hand's on) - London servicing & delivering WORLD WIDE

Tasnim Mushtaq Email Addresses

Tasnim Mushtaq Phone Numbers

Tasnim Mushtaq's Work Experience

CFO / Director and Interim Management Consultant (hand's on) - London servicing & deliver WORLD WIDE

February 1996 to Present

Corporate Senior Business Finance (Business Architect) Consultant (hand's on)

January 2014 to July 2014

IBM Middle East / Saudi Arabian Airlines (Saudi Arabia Government in process of Privatisation / IPO)

Senior Business Consultant (Architect) - hand’s on

June 2010 to December 2010

VOP TV / Kube Design

Commercial Director (Business Partners) (hand’s on, (B2B, B2C)

June 2007 to May 2010

Navision Business Consultant (Architect) via Michael Page

November 2008 to November 2008

DHL Worldwide Express

Interim Business Consultant (Project Management (PM) / Business Process Outsourcing (BPO)

May 2008 to June 2008

Verizon Business

Interim Senior Group Business Accountant “Deputy Head of Business Finance” (business continuity)

January 2008 to February 2008

Gyro International

Interim Senior Business Consultant (Group Consolidation)

January 2008 to January 2008

Nortel

Interim Business Consultant (Architect, Specialist Accountant) Business Process Re-engineering (BPR)

November 2006 to October 2007

Interim Business Architect Consultant / Group Consolidation Accountant - 2nd in command to NDA

June 2005 to May 2006

Show more

Show less

Tasnim Mushtaq's Education

Thames Valley University

January 1991 to January 1992

University of West London

January 1991 to January 1992

High Pavement Sixth Form College (Nottingham)

January 1985 to January 1987

Show more

Show less

Frequently Asked Questions about Tasnim Mushtaq

What is Tasnim Daniel Mushtaq email address?

Email Tasnim Daniel Mushtaq at [email protected] and [email protected]. This email is the most updated Tasnim Daniel Mushtaq's email found in 2024.

What is Tasnim Daniel Mushtaq phone number?

Tasnim Daniel Mushtaq phone number is + 44 (0) 771 911 2442.

How to contact Tasnim Daniel Mushtaq?

To contact Tasnim Daniel Mushtaq send an email to [email protected] or [email protected]. If you want to call Tasnim Daniel Mushtaq try calling on + 44 (0) 771 911 2442.

What company does Tasnim Mushtaq work for?

Tasnim Mushtaq works for Musketeer Enterprises

What is Tasnim Mushtaq's role at Musketeer Enterprises?

Tasnim Mushtaq is CFO / Director and Interim Management Consultant (hand's on) - London servicing & deliver WORLD WIDE

What industry does Tasnim Mushtaq work in?

Tasnim Mushtaq works in the Accounting industry.

Tasnim Mushtaq's Professional Skills Radar Chart

Based on our findings, Tasnim Mushtaq is ...

What's on Tasnim Mushtaq's mind?

Based on our findings, Tasnim Mushtaq is ...

Tasnim Mushtaq's Estimated Salary Range

Tasnim Mushtaq Email Addresses

Tasnim Mushtaq Phone Numbers

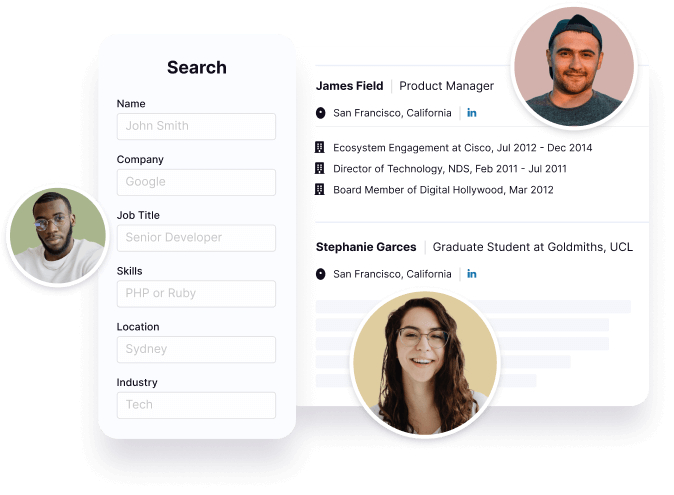

Find emails and phone numbers for 300M professionals.

Search by name, job titles, seniority, skills, location, company name, industry, company size, revenue, and other 20+ data points to reach the right people you need. Get triple-verified contact details in one-click.In a nutshell

Tasnim Mushtaq's Personality Type

Extraversion (E), Intuition (N), Thinking (T), Judging (J)

Average Tenure

2 year(s), 0 month(s)

Tasnim Mushtaq's Willingness to Change Jobs

Unlikely

Likely

Open to opportunity?

There's 76% chance that Tasnim Mushtaq is seeking for new opportunities

Tasnim Mushtaq's Social Media Links

/in/tasnimmushtaq www.musketeer-enterprises.com /watch www.jobserve.com