Russell Singleton's Email & Phone Number

Transformative Executive Leader - Maximizing results of growing medical device and life science businesses through: Transformational Leadership | Customer-Focused Strategy | Market-Driven Innovation

Russell Singleton Email Addresses

Russell Singleton Phone Numbers

Russell Singleton's Work Experience

Russ Singleton Consulting, LLC

CEO

January 2020 to Present

Russ Singleton Consulting

CEO

January 2011 to January 2014

Interim Vice President, Research and Development (Russ Singleton Consulting)

January 2013 to January 2014

Russ Singleton Consulting LLC

CEO

January 2011 to January 2014

Russ Singleton Consulting LLC

President

January 2011 to January 2013

Molecular Image, Inc.

President & CEO, Member of Board of Directors

January 2008 to January 2011

Philips Healthcare

General Manager

January 2006 to January 2007

Appalachian Electronic Instruments, Inc.

Key member of Board of Directors (Norgren Systems)

January 2004 to January 2005

Molecular Dynamics (now part of GE Healthcare)

Vice President, Engineering

January 1990 to January 1995

Russ Singleton Consulting, LLC

Interim COO, CTO and Business Advisor

VP, New Business Development, SVP Research & Development / Acting (Interim) Vice President, R&D

Show more

Show less

Russell Singleton's Education

Stanford University Graduate School of Business

University of Illinois at Urbana-Champaign

University of Illinois at Urbana-Champaign

Pratt Institute

Show more

Show less

Frequently Asked Questions about Russell Singleton

What is Russell M Singleton email address?

Email Russell M Singleton at [email protected], [email protected], [email protected] and [email protected]. This email is the most updated Russell M Singleton's email found in 2024.

What is Russell M Singleton phone number?

Russell M Singleton phone number is 650-384-0317 and 650-269-4391.

How to contact Russell M Singleton?

To contact Russell M Singleton send an email to [email protected], [email protected], [email protected] or [email protected]. If you want to call Russell M Singleton try calling on 650-384-0317 and 650-269-4391.

What company does Russell Singleton work for?

Russell Singleton works for Russ Singleton Consulting, LLC

What is Russell Singleton's role at Russ Singleton Consulting, LLC?

Russell Singleton is CEO

What industry does Russell Singleton work in?

Russell Singleton works in the Medical Device industry.

Russell Singleton's Professional Skills Radar Chart

Based on our findings, Russell Singleton is ...

What's on Russell Singleton's mind?

Based on our findings, Russell Singleton is ...

Russell Singleton's Estimated Salary Range

Russell Singleton Email Addresses

Russell Singleton Phone Numbers

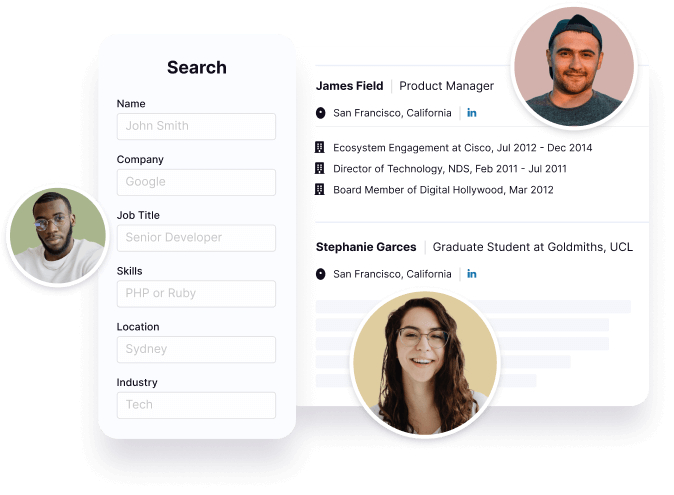

Find emails and phone numbers for 300M professionals.

Search by name, job titles, seniority, skills, location, company name, industry, company size, revenue, and other 20+ data points to reach the right people you need. Get triple-verified contact details in one-click.In a nutshell

Russell Singleton's Personality Type

Extraversion (E), Intuition (N), Thinking (T), Judging (J)

Average Tenure

2 year(s), 0 month(s)

Russell Singleton's Willingness to Change Jobs

Unlikely

Likely

Open to opportunity?

There's 70% chance that Russell Singleton is seeking for new opportunities

Russell Singleton's Social Media Links

/in/russellsingleton /school/stanford-graduate-school-of-business/