Naeem Bawla's Email & Phone Number

Founder - Bawla Consulting, a Financial Times and Inc Magazine Top 500 Entrepreneur

Naeem Bawla Email Addresses

Naeem Bawla Phone Numbers

Naeem Bawla's Work Experience

Nassau County Asian American Advisory Board

Board Member

May 2019 to Present

Cooper Sachs

Board Member

October 2020 to Present

Mindful Urgent Care

Investor and Advisor

November 2019 to Present

Bawla Consulting Inc., an Inc 500 Company

Founder / CEO

September 2014 to Present

Diaz Reus & Targ LLP

Summer Associate

May 2009 to June 2010

Show more

Show less

Frequently Asked Questions about Naeem Bawla

What company does Naeem Bawla work for?

Naeem Bawla works for Bawla Consulting Inc., an Inc 500 Company

What is Naeem Bawla's role at Bawla Consulting Inc., an Inc 500 Company?

Naeem Bawla is Founder / CEO

What is Naeem Bawla's personal email address?

Naeem Bawla's personal email address is n****[email protected]

What is Naeem Bawla's business email address?

Naeem Bawla's business email address is naeem.bawla@***.***

What is Naeem Bawla's Phone Number?

Naeem Bawla's phone (212) ***-*435

What industry does Naeem Bawla work in?

Naeem Bawla works in the Financial Services industry.

Naeem Bawla's Professional Skills Radar Chart

Based on our findings, Naeem Bawla is ...

What's on Naeem Bawla's mind?

Based on our findings, Naeem Bawla is ...

Naeem Bawla's Estimated Salary Range

Naeem Bawla Email Addresses

Naeem Bawla Phone Numbers

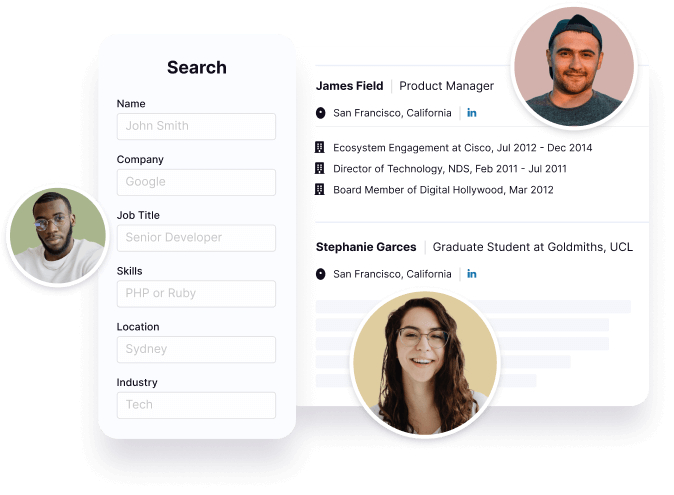

Find emails and phone numbers for 300M professionals.

Search by name, job titles, seniority, skills, location, company name, industry, company size, revenue, and other 20+ data points to reach the right people you need. Get triple-verified contact details in one-click.In a nutshell

Naeem Bawla's Ranking

Ranked #528 out of 10,555 for Founder / CEO in New York

Naeem Bawla's Personality Type

Extraversion (E), Intuition (N), Feeling (F), Judging (J)

Average Tenure

2 year(s), 0 month(s)

Naeem Bawla's Willingness to Change Jobs

Unlikely

Likely

Open to opportunity?

There's 75% chance that Naeem Bawla is seeking for new opportunities

Top Searched People

American motorsports racing driver and entrepreneur

American football player

American businesswoman

Mexican mixed martial artist

Baseball outfielder

Naeem Bawla's Social Media Links

/in/nbawla