Kevin Greene's Email & Phone Number

CEO, Redwood Software

Kevin Greene Email Addresses

Kevin Greene Phone Numbers

Kevin Greene's Work Experience

Zone Software Partners

CEO & Managing Partner

October 2021 to Present

Redwood Software

CEO

January 2022 to Present

General Manager, Logi Analytics an insightsoftware company

April 2021 to October 2021

BlueStripe Software (wholly owned subsidiary of Microsoft)

Board Director

January 2009 to September 2014

Flat World Knowledge, Inc.

Board Observer

January 2009 to April 2013

Valhalla Partners

Partner

September 2008 to April 2013

EnterpriseDB

Board Observer

January 2011 to January 2013

Rivermine Software (acquired by Marlin Equity Partners)

Board Observer

January 2009 to January 2011

Kauffman Fellows Program

Kauffman Fellow

January 2007 to January 2009

Flagship Ventures

Principal

June 2006 to July 2008

IntelliVid Corporation (acquired by Tyco)

Board Director

January 2007 to January 2008

Goldman Sachs & Co. (Asia) L.L.C.

Financial Analyst

July 1997 to July 1999

Show more

Show less

Kevin Greene's Education

Harvard Business School

January 2000 to January 2002

University of Virginia

January 1993 to January 1997

Annandale

January 1989 to January 1993

Show more

Show less

Frequently Asked Questions about Kevin Greene

What is Kevin Greene email address?

Email Kevin Greene at [email protected] and [email protected]. This email is the most updated Kevin Greene's email found in 2024.

How to contact Kevin Greene?

To contact Kevin Greene send an email to [email protected] or [email protected].

What company does Kevin Greene work for?

Kevin Greene works for Redwood Software

What is Kevin Greene's role at Redwood Software?

Kevin Greene is CEO

What is Kevin Greene's Phone Number?

Kevin Greene's phone (703) ***-*218

What industry does Kevin Greene work in?

Kevin Greene works in the Computer Software industry.

Kevin Greene's Professional Skills Radar Chart

Based on our findings, Kevin Greene is ...

What's on Kevin Greene's mind?

Based on our findings, Kevin Greene is ...

Kevin Greene's Estimated Salary Range

Kevin Greene Email Addresses

Kevin Greene Phone Numbers

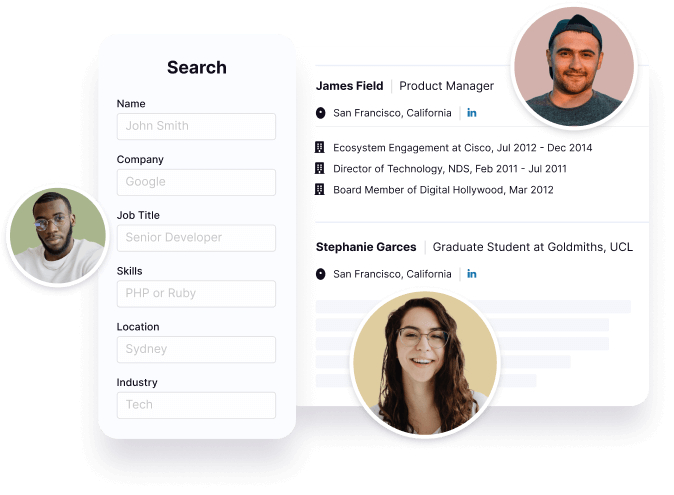

Find emails and phone numbers for 300M professionals.

Search by name, job titles, seniority, skills, location, company name, industry, company size, revenue, and other 20+ data points to reach the right people you need. Get triple-verified contact details in one-click.In a nutshell

Kevin Greene's Ranking

Ranked #169 out of 3,375 for CEO in Virginia

Kevin Greene's Personality Type

Introversion (I), Intuition (N), Thinking (T), Judging (J)

Average Tenure

2 year(s), 0 month(s)

Kevin Greene's Willingness to Change Jobs

Unlikely

Likely

Open to opportunity?

There's 77% chance that Kevin Greene is seeking for new opportunities

Top Searched People

American actress and comedian

American author and chef

Actor and film producer

Dancer

American basketball coach

Kevin Greene's Social Media Links

/in/kevinrgreene /company/logianalytics /school/harvard-business-school/