Joe Wansbrough's Email & Phone Number

Delivering strategies that prudently grow portfolios

Joe Wansbrough Email Addresses

Joe Wansbrough Phone Numbers

Joe Wansbrough's Work Experience

Head of Customer Credit and Pricing Optimization

Director

Team Lead

HSBC Finance

Senior Credit Risk Manager

Credit Risk Manager, Account Management

Canada Trust

Senior Forecasting Analyst

Canada Trust

Credit Risk Analyst

Econometrician

Research Assistant

Government of Canada

Statistian

Government of Ontario

Statistian

Show more

Show less

Joe Wansbrough's Education

Wilfrid Laurier University

MA Business Economics and Administration

Laurentian University/Université Laurentienne

HBA Economics

Show more

Show less

Frequently Asked Questions about Joe Wansbrough

What is Joe Wansbrough email address?

Email Joe Wansbrough at [email protected] and [email protected]. This email is the most updated Joe Wansbrough's email found in 2024.

How to contact Joe Wansbrough?

To contact Joe Wansbrough send an email to [email protected] or [email protected].

What company does Joe Wansbrough work for?

Joe Wansbrough works for BMO Financial Group

What is Joe Wansbrough's role at BMO Financial Group?

Joe Wansbrough is Head of Customer Credit and Pricing Optimization

What is Joe Wansbrough's Phone Number?

Joe Wansbrough's phone (416) ***-*282

What industry does Joe Wansbrough work in?

Joe Wansbrough works in the Consumer Goods industry.

Joe Wansbrough's Professional Skills Radar Chart

Based on our findings, Joe Wansbrough is ...

What's on Joe Wansbrough's mind?

Based on our findings, Joe Wansbrough is ...

Joe Wansbrough's Estimated Salary Range

Joe Wansbrough Email Addresses

Joe Wansbrough Phone Numbers

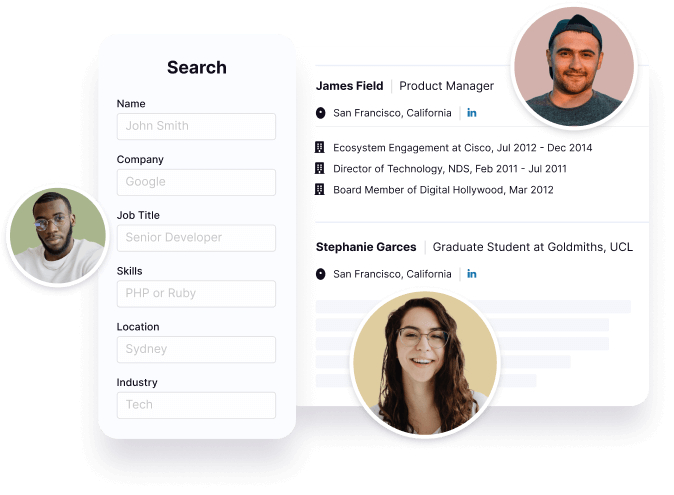

Find emails and phone numbers for 300M professionals.

Search by name, job titles, seniority, skills, location, company name, industry, company size, revenue, and other 20+ data points to reach the right people you need. Get triple-verified contact details in one-click.In a nutshell

Joe Wansbrough's Personality Type

Introversion (I), Intuition (N), Thinking (T), Judging (J)

Average Tenure

2 year(s), 0 month(s)

Joe Wansbrough's Willingness to Change Jobs

Unlikely

Likely

Open to opportunity?

There's 71% chance that Joe Wansbrough is seeking for new opportunities

Joe Wansbrough's Social Media Links

/in/joewansbrough