Jt Fisher's Email & Phone Number

Funeral home in Chesapeake, Virginia

Jt Fisher's Email Addresses

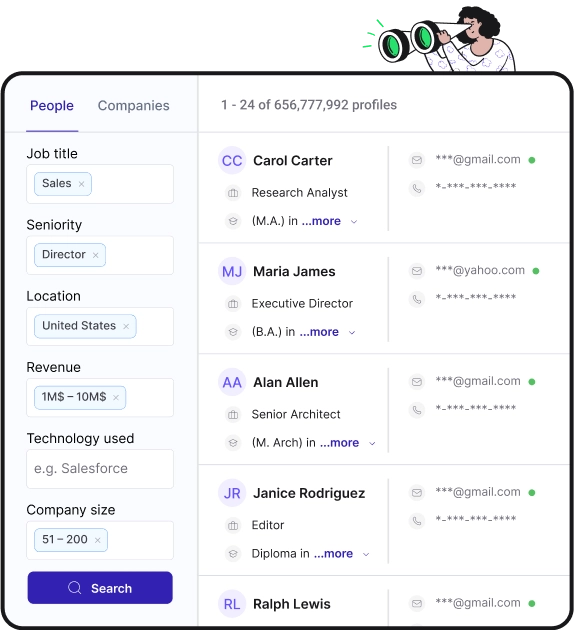

Find personal and work emails for over 300M professionals

Not the Jt Fisher you were looking for? Continue your search below:About Jt Fisher

📖 Summary

J.T. Fisher Funeral Services is a reputable funeral home located in Chesapeake, Virginia, known for providing compassionate and personalized funeral services to families in their time of need. With over 100 years of experience in the funeral industry, the team at J.T. Fisher Funeral Services is dedicated to guiding families through the difficult process of saying goodbye to their loved ones with dignity and respect.

The funeral home's mission is to provide meaningful and affordable funeral services that honor the life and memory of the deceased. They offer a range of funeral and memorial options, including traditional burial services, cremation services, and personalized memorial services. Whether a family chooses a traditional church service followed by burial or a contemporary celebration of life, the experienced staff at J.T. Fisher Funeral Services is committed to creating a service that reflects the uniqueness of each individual.

In addition to funeral and memorial services, J.T. Fisher Funeral Services provides pre-planning and pre-payment options to help individuals make important decisions about their end-of-life care. Their compassionate and knowledgeable staff is available to assist with all aspects of funeral planning, including selecting caskets, urns, and memorial products. They also offer grief support and aftercare services to help families cope with the loss of their loved ones.

One of the distinguishing features of J.T. Fisher Funeral Services is their state-of-the-art facility, which is designed to provide comfort and convenience to grieving families. The funeral home offers a spacious chapel for funeral and memorial services, as well as a reception area for hosting gatherings and sharing memories. The facility also includes a viewing room and arrangement conference rooms, allowing families to make funeral arrangements in a peaceful and private setting.

At J.T. Fisher Funeral Services, the staff understands the importance of personalization when it comes to honoring a loved one's life. They work closely with families to create unique and meaningful tributes, incorporating personal touches and special memories into the funeral service. The funeral home also offers a variety of customizable options, such as video tributes, memorial stationery, and online obituaries, to help families create a fitting tribute to their loved one.

With a commitment to providing compassionate care and exceptional service, J.T. Fisher Funeral Services has earned a reputation as a trusted provider of funeral and memorial services in Chesapeake, Virginia. Families turn to J.T. Fisher Funeral Services during their time of grief, knowing that they will receive professional and compassionate support from a team that is dedicated to helping them through the difficult process of saying goodbye to a loved one.

In conclusion, J.T. Fisher Funeral Services is a well-respected funeral home in Chesapeake, Virginia, with a long-standing tradition of providing compassionate and personalized funeral services. With a dedicated team of professionals and a state-of-the-art facility, the funeral home is equipped to meet the needs of families during their time of grief, offering a range of funeral and memorial options, pre-planning services, and aftercare support. Families in the Chesapeake area can trust J.T. Fisher Funeral Services to guide them through the difficult process of saying goodbye to their loved ones with dignity and respect.

Jt Fisher's Email Addresses

People you may be

interested in

American actress and singer

American comedian and actress

American actress

Internet personality

Australian director and animator

American actress and singer

American singer and dancer

Football wide receiver

Broadcaster and journalist

American actor

Swiss ice hockey winger

Nigerian actress and film producer