Guillaume Rimbaut's Email & Phone Number

Chief Risk Officer (CRO) at Charles Stanley & Co. Limited

Guillaume Rimbaut Email Addresses

Guillaume Rimbaut Phone Numbers

Guillaume Rimbaut's Work Experience

Head of Operational Risk, Cofunds & Suffolk Life

Senior Risk Manager

Principal Consultant, Actuarial and Analytical Services, Aon Global Risk Consulting

Head of Operational Risk Framework Design & Insight

Senior Operational Risk Manager, Group Risk

Barclays plc

Operational Risk Manager

Ford Motor Credit Company

Supervisor, Corporate Recovery

Show more

Show less

Guillaume Rimbaut's Education

ESC Compiègne

Masters Business Finance Accounting Corporate Law

Classe Preparatoire HEC, Amiens

Baccalaureat S (science), Lycée du Sacré-Coeur, Amiens

Science

Show more

Show less

Frequently Asked Questions about Guillaume Rimbaut

What company does Guillaume Rimbaut work for?

Guillaume Rimbaut works for Legal & General

What is Guillaume Rimbaut's role at Legal & General?

Guillaume Rimbaut is Head of Operational Risk, Cofunds & Suffolk Life

What is Guillaume Rimbaut's personal email address?

Guillaume Rimbaut's personal email address is gu****[email protected]

What is Guillaume Rimbaut's business email address?

Guillaume Rimbaut's business email address is g****[email protected]

What is Guillaume Rimbaut's Phone Number?

Guillaume Rimbaut's phone +44 ** **** *222

What industry does Guillaume Rimbaut work in?

Guillaume Rimbaut works in the Financial Services industry.

Guillaume Rimbaut's Professional Skills Radar Chart

Based on our findings, Guillaume Rimbaut is ...

What's on Guillaume Rimbaut's mind?

Based on our findings, Guillaume Rimbaut is ...

Guillaume Rimbaut's Estimated Salary Range

Guillaume Rimbaut Email Addresses

Guillaume Rimbaut Phone Numbers

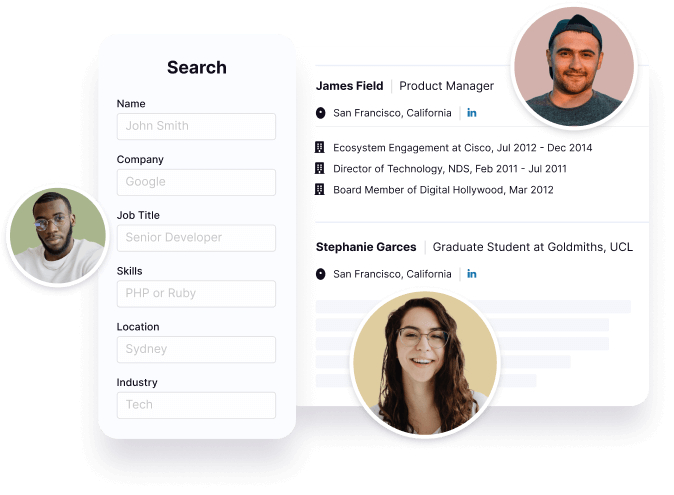

Find emails and phone numbers for 300M professionals.

Search by name, job titles, seniority, skills, location, company name, industry, company size, revenue, and other 20+ data points to reach the right people you need. Get triple-verified contact details in one-click.In a nutshell

Guillaume Rimbaut's Personality Type

Extraversion (E), Sensing (S), Feeling (F), Perceiving (P)

Average Tenure

2 year(s), 0 month(s)

Guillaume Rimbaut's Willingness to Change Jobs

Unlikely

Likely

Open to opportunity?

There's 76% chance that Guillaume Rimbaut is seeking for new opportunities

Top Searched People

Internet personality

American track and field athlete

CEO of Activision Blizzard

American singer and songwriter

Puerto Rican basketball shooting guard

Guillaume Rimbaut's Social Media Links

/in/guillaume-rimbaut-29b53511