David True's Email & Phone Number

Fintech Geek, Payments Guy, Always Curious

David True Email Addresses

David True Phone Numbers

David True's Work Experience

Bankable Fintech

Advisor

May 2018 to Present

Agora Services

Senior Advisor

December 2019 to Present

NYPAY

President & Board Member

January 2012 to Present

GPF Holdings, LLC

Member Of The Board Of Advisors

June 2020 to Present

Yiftee | data-driven mobile promotions & gifting

Advisory Board Member

August 2015 to Present

Broadly Curious Advisors

Managing Director

January 2011 to Present

Paygility Advisors

Partner

February 2016 to Present

motivote

Advisor

July 2018 to June 2020

GPF Holdings, LLC

Advisor

November 2019 to June 2020

token payments, inc.

Founder Advisor

January 2017 to December 2019

Autoback

Board Member

July 2016 to July 2018

Seqr Payments, Inc.

General Manager, US

June 2016 to March 2018

MasterCard Worldwide

Vice President, Global Account Development

January 2010 to October 2010

MasterCard Worldwide

Vice President, Sales Planning

May 2007 to January 2010

American Express

Consultant to Cardless Payment group

January 2007 to April 2007

American Express

Consultant to OPEN The Small Business Network

September 2006 to December 2006

American Express

Consultant to Establishment Services

October 2005 to December 2006

American Express

Consultant to Travellers Cheque and Prepaid Services Group

November 2004 to September 2005

American Express

Consultant to Operations Finance

July 2003 to October 2004

MBAs4NYC

Small Business Consultant

August 2002 to April 2003

D&B

Consultant to Customer Development Group

May 2002 to July 2002

American Express

Director-Business Alliances

August 1999 to January 2002

American Express

Director-International Finance

March 1996 to July 1999

American Express

Director-Treasury

January 1989 to January 1995

NEU-EUROPA HITEC & BIOTEC

Venture Capital Associate

January 1987 to January 1988

Saudi Aramco

Consultant

January 1981 to January 1984

Paygility Advisors

Show more

Show less

David True's Education

The University of Chicago Booth School of Business

January 1985 to January 1987

Binghamton University

January 1975 to January 1979

Show more

Show less

Frequently Asked Questions about David True

What is David True email address?

Email David True at [email protected], [email protected], [email protected], [email protected] and [email protected]. This email is the most updated David True's email found in 2024.

What is David True phone number?

David True phone number is 801.613.0366, +1 646.729.5811 and 8606934947.

How to contact David True?

To contact David True send an email to [email protected], [email protected], [email protected], [email protected] or [email protected]. If you want to call David True try calling on 801.613.0366, +1 646.729.5811 and 8606934947.

What company does David True work for?

David True works for Broadly Curious Advisors

What is David True's role at Broadly Curious Advisors?

David True is Managing Director

What industry does David True work in?

David True works in the Financial Services industry.

David True's Professional Skills Radar Chart

Based on our findings, David True is ...

What's on David True's mind?

Based on our findings, David True is ...

David True's Estimated Salary Range

David True Email Addresses

David True Phone Numbers

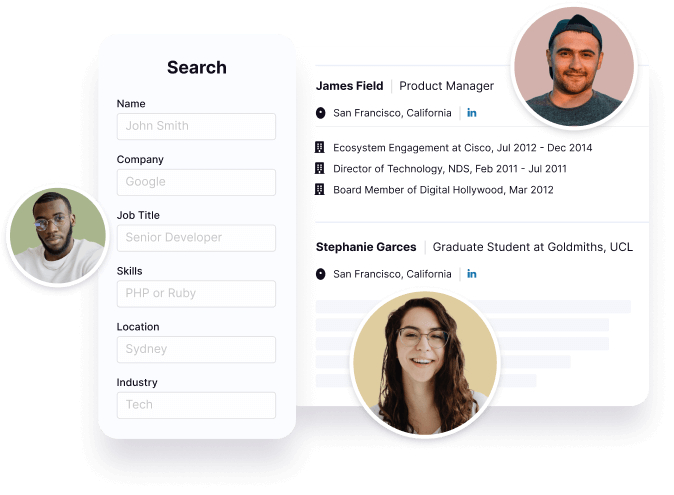

Find emails and phone numbers for 300M professionals.

Search by name, job titles, seniority, skills, location, company name, industry, company size, revenue, and other 20+ data points to reach the right people you need. Get triple-verified contact details in one-click.In a nutshell

David True's Ranking

Ranked #456 out of 9,125 for Managing Director in New York

David True's Personality Type

Extraversion (E), Intuition (N), Feeling (F), Judging (J)

Average Tenure

2 year(s), 0 month(s)

David True's Willingness to Change Jobs

Unlikely

Likely

Open to opportunity?

There's 76% chance that David True is seeking for new opportunities

David True's Social Media Links

/in/dptrue /company/paygility-advisors