Christian Ransby's Email & Phone Number

Senior Project / Programme Manager delivering Business and/or Regulatory Change

Christian Ransby Email Addresses

Christian Ransby Phone Numbers

Christian Ransby's Work Experience

Business Analyst

Vice President

Business Analyst

Head of Asset Services

Manager

Member of Securities Market Practice Group

The Danish Bankers Association

Representing SEB in various CA and Corporate Governance related workgroups

Venstre

Danish Liberal Party - Member of the EU Forum

Corporate Actions Manager

SEB Kort

Corporate Credit Consultant

Venstre on Oesterbro - Danish liberal Party

Board Member

AL Bank

Financial Advisor

Show more

Show less

Christian Ransby's Education

Copenhagen Business School

Graduate Diploma (HD) in Business Administration (Accounting Control & Process Management) Strategic Management / Business Transformation Strategies / Management Accounting / Process Manageme

Copenhagen Business School

BsC Economics and Business administration

AL-Bank

Financial Trainee Banking

Niels Brock Copenhagen Business College

Financial Advisor

Odense Business College

HhX Economy

Show more

Show less

Frequently Asked Questions about Christian Ransby

What is Christian Ransby email address?

Email Christian Ransby at [email protected]. This email is the most updated Christian Ransby's email found in 2024.

How to contact Christian Ransby?

To contact Christian Ransby send an email to [email protected].

What company does Christian Ransby work for?

Christian Ransby works for Lloyds Banking Group

What is Christian Ransby's role at Lloyds Banking Group?

Christian Ransby is Business Analyst

What is Christian Ransby's Phone Number?

Christian Ransby's phone +44 ** **** *964

What industry does Christian Ransby work in?

Christian Ransby works in the Investment Banking industry.

Christian Ransby's Professional Skills Radar Chart

Based on our findings, Christian Ransby is ...

What's on Christian Ransby's mind?

Based on our findings, Christian Ransby is ...

Christian Ransby's Estimated Salary Range

Christian Ransby Email Addresses

Christian Ransby Phone Numbers

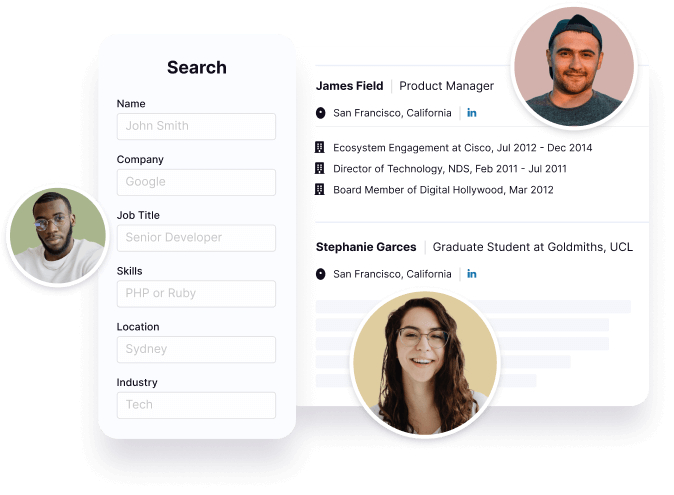

Find emails and phone numbers for 300M professionals.

Search by name, job titles, seniority, skills, location, company name, industry, company size, revenue, and other 20+ data points to reach the right people you need. Get triple-verified contact details in one-click.In a nutshell

Christian Ransby's Personality Type

Introversion (I), Intuition (N), Thinking (T), Judging (J)

Average Tenure

2 year(s), 0 month(s)

Christian Ransby's Willingness to Change Jobs

Unlikely

Likely

Open to opportunity?

There's 88% chance that Christian Ransby is seeking for new opportunities

Top Searched People

American actor and singer

American racer

CEO of Yelp

Nigerian basketball player

American former football player

Christian Ransby's Social Media Links

/in/christransby