Owen Jones's Email & Phone Number

British columnist

Owen Jones's Email Addresses

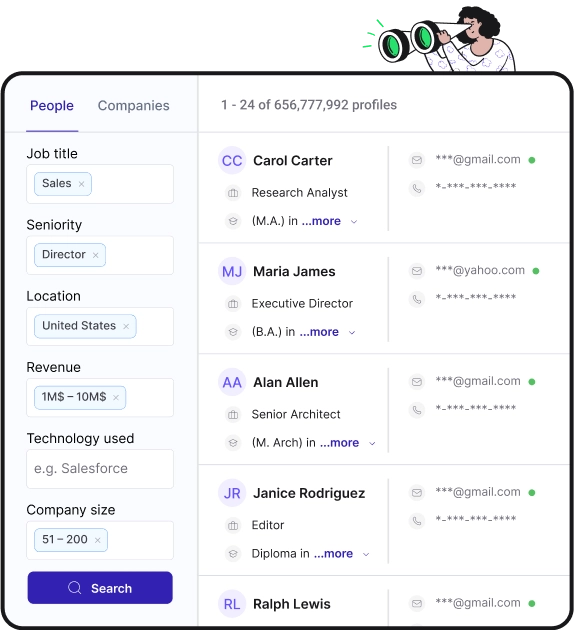

Find personal and work emails for over 300M professionals

Not the Owen Jones you were looking for? Continue your search below:About Owen Jones

📖 Summary

Owen Jones is a prominent British columnist who has made a name for himself through his incisive and thought-provoking commentary on a wide range of political and social issues. Known for his unapologetically left-wing perspective, Jones has become a leading voice in the fight for social justice and equality in the UK.

Born in Sheffield in 1984, Jones studied history at Oxford University before embarking on a career in journalism. He gained early recognition for his writing while still a student, and his columns were soon picked up by national newspapers, including The Guardian and The Independent. It was during this time that he began to develop the compelling and passionate style that would come to define his work.

One of the key themes in Jones's writing is inequality, and he has been a vocal critic of the growing gap between the rich and the poor in the UK. He has written extensively about the impact of austerity measures on working-class communities, and has called for a more progressive approach to economic policy. His insights into the ways in which inequality manifests itself in society have resonated with many readers, and have helped to elevate the issue onto the national agenda.

In addition to his focus on economic inequality, Jones has also been an outspoken advocate for LGBTQ+ rights, women's rights, and racial justice. He has used his platform to highlight the struggles faced by marginalized communities, and has called for concrete action to address systemic discrimination and oppression. These efforts have earned him a reputation as a fierce and principled advocate for social change.

Jones's columns are characterized by their sharp wit and uncompromising analysis. He is not afraid to tackle controversial topics, and has been known to take on powerful figures in politics and the media. His willingness to challenge the status quo has made him a polarizing figure, with some praising his courage and insight, while others accuse him of being overly partisan.

In recent years, Jones has expanded his reach beyond his writing, becoming a well-known commentator on television and radio. He has made regular appearances on shows such as Newsnight and Question Time, where he has continued to make the case for progressive change. His ability to communicate complex ideas in a clear and compelling manner has made him a sought-after voice in the media landscape.

Beyond his work in journalism, Jones is also the author of several bestselling books, including "Chavs: The Demonization of the Working Class" and "The Establishment: And How They Get Away with It." These books have further cemented his reputation as a leading thinker on issues of social justice and class struggle. They have also helped to introduce his ideas to a wider audience, making him a key figure in the public discourse on these important topics.

In all of his work, Jones remains committed to the idea that a better world is possible, and he continues to challenge his readers and viewers to think critically about the issues that shape our society. While he may not be everyone's cup of tea, there is no denying that Owen Jones is a force to be reckoned with in the world of British commentary. Whether through his writing, his speaking engagements, or his media appearances, he has proven himself to be an indispensable voice for progressive change.

Frequently Asked Questions about Owen Jones

What is Owen Jones's email address?

Owen Jones's email address is [email protected] . This email is the most updated Owen Jones's email found in 2024.

How to contact Owen Jones?

To contact Owen Jones send an email at [email protected] .

Who is John Owen Jones married to?

Teresa Chilton

What did Owen Jones study at Oxford?

Jones attended Bramhall High School and Ridge Danyers Sixth Form College and studied history at University College, Oxford, graduating with a BA in 2005 and a Master of Studies in US History in 2007.

Owen Jones's Email Addresses

People you may be

interested in

American actress

American TV personality and entrepreneur

Actor

Turkish football manager

TV personality

American TV personality

Musician

American actress and singer

Football quarterback

American singer

American actress

Spanish host and comedian