Mark Robinson's Email & Phone Number

Lieutenant Governor of North Carolina

Mark Robinson's Email Addresses

Mark Robinson's Phone Numbers

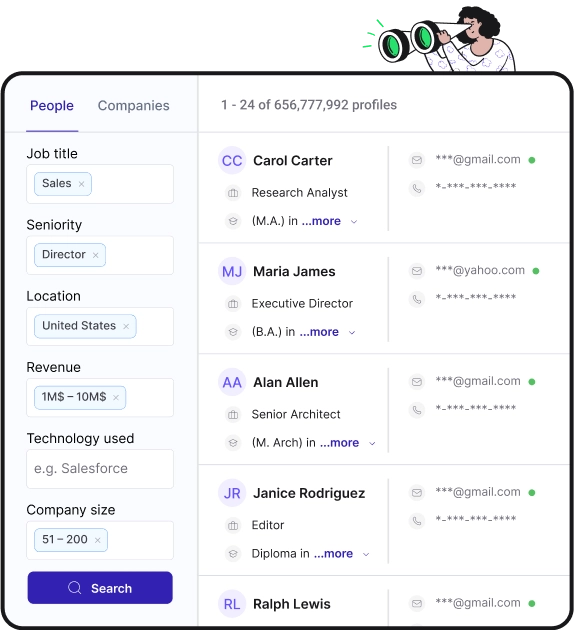

Find personal and work emails for over 300M professionals

Not the Mark Robinson you were looking for? Continue your search below:About Mark Robinson

📖 Summary

Mark Robinson, the Lieutenant Governor of North Carolina, is a charismatic and outspoken leader who has quickly become a force to be reckoned with in state politics. With his infectious energy and unwavering dedication to conservative values, Robinson has emerged as a rising star in the Republican Party, captivating both supporters and skeptics alike.

Born and raised in Greensboro, North Carolina, Robinson grew up in a working-class family. He faced numerous challenges, including poverty and discrimination, but these experiences shaped the resilient and determined individual he is today. After completing his education, Robinson worked in various construction and factory jobs, always striving to provide for his family and pursue the American dream.

Robinson's political career began when he made a passionate speech during a city council meeting in 2018, defending the rights of law-abiding gun owners. The video of his speech went viral, garnering millions of views and catapulting him into the national spotlight. This breakthrough moment propelled Robinson to run for the office of Lieutenant Governor in 2020, where he captured the hearts and minds of North Carolinians with his unique blend of authenticity, conviction, and charisma.

As Lieutenant Governor, Robinson wasted no time in making his mark. He prioritizes the values that have guided him throughout his life, advocating for smaller government, individual liberty, and fiscal responsibility. Robinson firmly believes that the government's role should be limited, with power ultimately residing in the hands of the people. He strives to protect the Constitution and its guarantees, ensuring that citizens' rights are upheld and their voices are heard.

One of Robinson's key initiatives is supporting the Second Amendment rights of North Carolinians. Drawing from his personal experiences, he passionately defends the right to bear arms and opposes any measures that would infringe upon these fundamental freedoms. Robinson firmly believes that an armed citizenry is essential to preserving individual liberties and safeguarding against government overreach.

In addition to his focus on the Second Amendment, Robinson is a staunch advocate for education reform. As a product of the public school system, he understands the importance of quality education and its potential to transform lives. He seeks to empower parents with choice and opportunity, supporting school vouchers and charter schools as alternatives to traditional public education. Robinson firmly believes that every child deserves access to a quality education, regardless of their zip code or socioeconomic background.

Robinson's appeal lies not only in his policy positions, but also in his ability to connect with people from all walks of life. Whether it's through his electrifying speeches or his engaging social media presence, he has a unique talent for inspiring and mobilizing supporters. Robinson's communication style is straightforward and relatable, allowing him to effectively convey his message and connect with the hearts and minds of his audience.

With his rising national prominence, many see Robinson as a potential contender for higher office in the future. His unwavering commitment to conservative principles, coupled with his magnetic personality, positions him as a compelling figure in the Republican Party. Whether it's his focus on protecting individual liberties, championing the Second Amendment, or advocating for education reform, Robinson's unapologetic conservatism has struck a chord with conservatives across the nation.

In conclusion, Mark Robinson, the Lieutenant Governor of North Carolina, represents the fresh face of leadership in today's political landscape. With his inspiring personal journey, powerful oratory skills, and deeply held conservative values, he has captured the imagination of North Carolinians and conservatives nationwide. Robinson's commitment to limited government, individual liberties, and education reform make him a beacon of hope for those seeking a principled and passionate leader. As he continues to make his mark on the state and national stage, it is clear that Mark Robinson's star is on the rise.

Frequently Asked Questions about Mark Robinson

What is Mark Robinson email address?

Email Mark Robinson at [email protected] and [email protected]. This email is the most updated Mark Robinson email found in 2024.

What is Mark Robinson phone number?

Mark Robinson phone number is 3362722456.

How to contact Mark Robinson?

To contact Mark Robinson send an email at [email protected] or [email protected]. If you want to call Mark Robinson try calling on 3362722456.

What does Mark Robinson do for a living?

Politician Mark Robinson / Profession

Did Mark Robinson serve in the military?

After high school, he served in the Army Reserve, later attending North Carolina A&T State University and working at several furniture factories in the Triad region.

Who is running for NC governor 2024?

Republican Lt. Gov. Mark Robinson (left) and Democratic Attorney General Josh Stein (right) are viewed as the early frontrunners for their respective party's nomination in the 2024 North Carolina governor's race.

What does the NC Lieutenant Governor do?

By virtue of the office (Ex officio), the lieutenant governor is a member of the Council of State, the North Carolina Board of Education, the North Carolina Capital Planning Commission, and the North Carolina Board of Community Colleges, and serves as the Chairman of the eLearning Commission.

Mark Robinson's Email Addresses

Mark Robinson's Phone Numbers

People you may be

interested in

Gamer

American businesswoman and fashion designer

American singer-songwriter

French journalist

British actor

American radio DJ and actor

Colombian actor

American actress and singer

Football running back

American basketball shooting guard

American entrepreneur and venture capitalist

Senior Technical Recruiter at CrowdStrike