George Ferris's Email & Phone Number

American civil engineer

George Ferris's Email Addresses

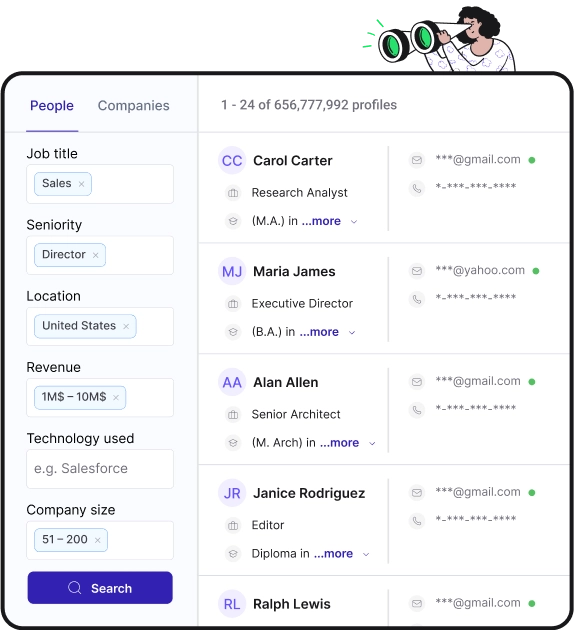

Find personal and work emails for over 300M professionals

Not the George Ferris you were looking for? Continue your search below:About George Ferris

📖 Summary

George Ferris was an American civil engineer best known for creating one of the most iconic landmarks in the world - The Ferris Wheel. Born in Galesburg, Illinois in 1859, Ferris showed an early interest in engineering and mechanics, which eventually led him to pursue a career in civil engineering.

After completing his education at Rensselaer Polytechnic Institute, Ferris went on to work on various engineering projects, gaining experience and recognition in the field. However, it wasn't until the Chicago World's Columbian Exposition of 1893 that Ferris would make his mark on history.

The organizers of the Chicago World's Fair issued a challenge for engineers to design a monument that would rival the Eiffel Tower, the centerpiece of the previous World's Fair in Paris. George Ferris saw this as an opportunity to showcase his engineering prowess and proposed the idea of a colossal rotating wheel that would provide a unique and awe-inspiring experience for fair attendees.

Ferris's design called for a 264-foot tall wheel with 36 cars, each capable of accommodating 60 people, allowing a total of 2,160 passengers to enjoy breathtaking views of the fairgrounds and the city of Chicago. The ambitious project was met with skepticism and resistance from many, who doubted the structural integrity and safety of such a colossal structure.

Despite the doubts and challenges, Ferris remained undeterred and managed to secure financing for the project. Construction of the Ferris Wheel began in 1892, and it was completed in time for the opening of the Chicago World's Fair in 1893. The Ferris Wheel quickly became the star attraction of the fair, drawing massive crowds and earning the admiration of all who experienced it.

The success of the Ferris Wheel at the Chicago World's Fair solidified George Ferris's legacy as a visionary engineer and innovator. His creation not only provided fair attendees with a remarkable experience but also set a new standard for amusement park attractions. The Ferris Wheel became a symbol of engineering excellence and creativity, inspiring countless other engineers and architects to push the boundaries of what was possible in their respective fields.

Ferris continued to work on various engineering projects after the Chicago World's Fair, but none would ever surpass the impact and significance of his iconic creation. Tragically, George Ferris's life was cut short when he passed away in 1896 at the age of 37. However, his legacy lived on through the enduring popularity of the Ferris Wheel and the impact he had on the field of civil engineering.

George Ferris's innovative spirit and determination serve as an inspiration to aspiring engineers and creators. His ability to think outside the box and his unwavering belief in his vision allowed him to achieve what many thought was impossible. The Ferris Wheel stands as a testament to his ingenuity and remains a beloved symbol of fun and adventure for people of all ages.

In conclusion, George Ferris was a pioneering civil engineer who left an indelible mark on history with his creation of the iconic Ferris Wheel. His innovative design and unwavering determination to bring his vision to life continue to inspire engineers and dreamers around the world. While his life was tragically short, his legacy lives on through the enduring popularity of the Ferris Wheel and the impact he had on the field of civil engineering. George Ferris will always be remembered as a visionary whose contributions to engineering and entertainment continue to be celebrated.

George Ferris's Email Addresses

People you may be

interested in

Writer

American actor and film producer

Talent Acquisition Manager - Global Solutions at Avanade

𝗧𝗼𝗺𝗼𝗿𝗿𝗼𝘄: Robotics & Software Engineer →𝗧𝗼𝗱𝗮𝘆: Manuf. Tech @ Intel

Program Analyst, Presidential Management Fellow at USAID

Category Management / Business Development / Innovation / Program & Process Management / Instructor / Aspiring Coach / Well-being Enthusiast

District Manager

Senior Product Manager

Film Assistant at MARV STUDIOS LIMITED

✧ | the evolution of voiceover | African-American Voice Actor | Commercial | Narration | eLearning | Explainers | Promo | Telephony | Video Games | Live Announce | Emcee | ✧

Regional Sales Manager - National Security, Military, Cyber Security and HealthCare at Cisco