Christopher Reed's Email Addresses

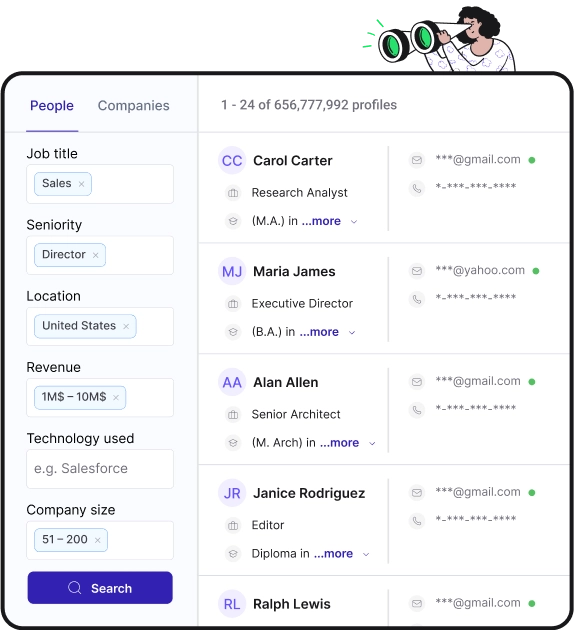

Find personal and work emails for over 300M professionals

Not the Christopher Reed you were looking for? Continue your search below:About Christopher Reed

📖 Summary

Christopher Reed is an accomplished actor who has made a name for himself in the world of film and television. With a career spanning over two decades, Reed has proven himself to be a versatile and talented performer, capable of taking on a wide range of roles and bringing them to life with his unique blend of charisma, charm, and skill.

Reed first burst onto the scene in the early 2000s, quickly establishing himself as a rising star with standout performances in a variety of projects. His natural talent and dedication to his craft quickly caught the attention of industry insiders, and it wasn't long before he was being sought after for high-profile roles in both film and television.

One of Reed's most memorable early roles came in the form of a critically acclaimed indie film that showcased his ability to tackle complex and emotionally demanding characters. His performance in this project earned him widespread praise and further solidified his status as a talent to watch in the entertainment industry. From there, Reed continued to build momentum, taking on a diverse array of roles that allowed him to showcase his range as an actor.

In addition to his work on the big screen, Reed has also made a name for himself in the world of television, with appearances in a number of popular shows. Whether he's playing a suave and sophisticated leading man or a charismatic and enigmatic villain, Reed brings a magnetic presence to the small screen, captivating audiences with his undeniable on-screen charisma and dynamic performances.

Reed's ability to inhabit a wide range of characters with depth and authenticity has earned him a dedicated fan base and widespread acclaim from critics and audiences alike. His performances have garnered him numerous award nominations and have established him as a force to be reckoned with in the entertainment industry.

In addition to his work in front of the camera, Reed has also demonstrated his talents behind the scenes, with several successful producing credits to his name. His keen eye for storytelling and his passion for bringing compelling narratives to life have made him a sought-after collaborator in the industry, and his projects have earned critical and commercial success.

As an actor, Reed is known for his versatility, his commitment to his craft, and his ability to deliver compelling and memorable performances. Whether he's playing a dramatic role that requires emotional depth and vulnerability or a comedic character that demands impeccable timing and wit, Reed consistently rises to the occasion, bringing a level of skill and artistry to his work that sets him apart from his peers.

With his impressive body of work and his ongoing dedication to his craft, Christopher Reed has firmly established himself as one of the most exciting and talented actors in the industry today. His ability to inhabit a wide range of characters with depth and nuance, his magnetic on-screen presence, and his commitment to his art make him a true standout in the world of entertainment.

As his career continues to evolve, Christopher Reed remains a captivating and in-demand performer, consistently delivering powerful and unforgettable performances that showcase his remarkable talent and make a lasting impression on audiences around the world. Whether he's bringing larger-than-life characters to the screen or delving into the emotional complexities of more grounded roles, Reed's performances are always captivating, engaging, and utterly unforgettable. With his natural charisma, his versatility as an actor, and his unwavering commitment to his craft, Christopher Reed is a true force to be reckoned with in the world of entertainment, and his star is sure to continue to rise for years to come.

Frequently Asked Questions about Christopher Reed

Who is Chris Reed?

Christopher Reed (born July 22, 1992) is an American football guard for the Minnesota Vikings of the National Football League (NFL). He was signed as an undrafted free agent by the Jacksonville Jaguars after the 2015 NFL Draft.

What are Christopher Reed's powers in solo leveling?

Ruler's Authority: Chris was able to control and move objects via telekinesis. Spiritual Body Manifestation: Chris was able to transform into an one-eyed giant with flaming light orange hair. The flames he could generate from this ability were so potent that it took 14 S-Rank Hunters to extinguish them.

What number is Chris Reed for the Vikings?

62: Chris Reed, C/G.Jul 27, 2023

Who was Pete in Rudy?

Pete is played by Christopher Reed. In the movie, Pete is Rudy's best friend and the only person who believes that he can make it to Notre Dame. When Pete dies in an accident at work, this throws Rudy over the edge. Pete's death pushes Rudy to go to South Bend and try to get into Notre Dame.

Christopher Reed's Email Addresses

People you may be

interested in

Actress

Actor

United States Representative

American basketball small forward

American actress

Member of the Lok Sabha

American actor and filmmaker

American singer

American actress

American actress and model

Actor at HBO Max

American internet entrepreneur and investor