Brian Wilson's Email & Phone Number

American musician and singer-songwriter

Brian Wilson's Email Addresses

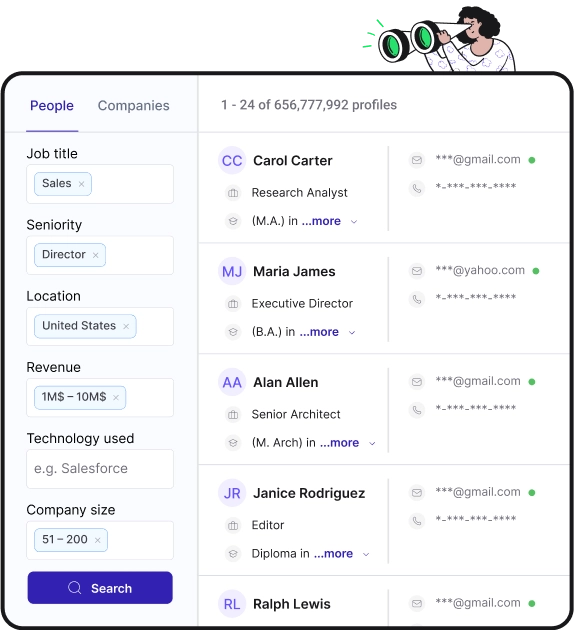

Find personal and work emails for over 300M professionals

Not the Brian Wilson you were looking for? Continue your search below:About Brian Wilson

📖 Summary

Brian Wilson, the legendary American musician and singer-songwriter, is a force to be reckoned with in the world of music. As the creative genius behind The Beach Boys, Wilson elevated the landscape of popular music, infusing it with his distinct musical vision and unbridled innovation. His unparalleled talent and groundbreaking compositions have left an indelible mark on the industry, inspiring countless artists and earning him a place among the most influential figures in rock and roll history.

Born on June 20, 1942, in Inglewood, California, Brian Wilson displayed an innate musical ability from a young age. With his brothers Dennis and Carl, his cousin Mike Love, and their friend Al Jardine, Wilson formed The Beach Boys in 1961. From their early surf-rock hits like "Surfin' USA" and "California Girls" to their more complex, introspective masterpieces like "God Only Knows" and "Good Vibrations," Wilson's musical prowess was evident in every note.

What truly set Wilson apart, however, was his unrivaled ability to arrange intricate harmonies and orchestral layers in a way that had never been done before. His use of innovative studio techniques and his knack for sophisticated arrangements pushed the boundaries of what was possible in popular music. Wilson's approach to songwriting went beyond just crafting catchy melodies; he was a true storyteller, painting vivid pictures with his lyrics and melodies, capturing the essence of the California lifestyle and the universal themes of love, longing, and self-discovery.

However, Wilson's creative journey was not without its struggles. As the pressures of fame and the demanding expectations of the music industry mounted, Wilson's mental health began to deteriorate. This culminated in a breakdown during the recording of "Smile," an ambitious and groundbreaking album that, at the time, was left unfinished. The experience took a toll on Wilson, and he retreated from the spotlight for years.

Fortunately, Wilson found solace in music therapy and a supportive network of friends and family. In the late 1980s, he made a triumphant return to the stage and studio, reclaiming his rightful place as one of music's greatest talents. He released his debut solo album, "Brian Wilson," in 1988, which showcased his incomparable songwriting ability and the sheer depth of his musical imagination. Collaborations with talented musicians such as Van Dyke Parks and Jeff Lynne allowed Wilson to explore new musical horizons while staying true to his signature sound.

In the years that followed, Wilson continued to release critically acclaimed albums such as "Smile" (finally completed in 2004) and "That Lucky Old Sun." His live performances also became legendary, earning him a reputation as an awe-inspiring performer who could transport audiences back in time with his timeless songs and soaring, multi-part harmonies.

Brian Wilson's impact on the music industry extends far beyond his own career. His innovative spirit and willingness to experiment with new sounds and techniques paved the way for countless musicians to explore and push the boundaries of their craft. His influence can be heard in the works of artists as diverse as The Beatles, Pink Floyd, and Radiohead, who have all acknowledged their debt to his groundbreaking compositions.

Furthermore, Wilson's personal journey and resilience have served as an inspiration to many. His struggles with mental health and substance abuse have been well-documented, but his refusal to let these challenges define him speaks volumes about his tenacity and strength. Throughout his life, Wilson has been an advocate for mental health awareness and has used his own experiences to bring attention to the importance of seeking help and support.

In recognition of his immense contributions to music, Brian Wilson has received numerous accolades, including induction into the Rock and Roll Hall of Fame as a member of The Beach Boys and a Grammy Lifetime Achievement Award. His impact on the industry is immeasurable, and his legacy will continue to shape the landscape of popular music for generations to come.

In the ever-evolving world of music, few figures can claim to be as influential, visionary, and enduring as Brian Wilson. Through his timeless compositions, his technical innovations, and his unyielding creativity, Wilson has not only left an indelible mark on the music industry but has also touched the hearts and souls of countless listeners around the world. His music is a testament to the power of artistic expression and the enduring ability of melodies and harmonies to connect us all.

Frequently Asked Questions about Brian Wilson

Why did Brian Wilson stop singing?

The creative genius behind The Beach Boys, Brian Wilson has long suffered from mental illness. He experienced a nervous breakdown in 1964 and resigned from touring, but stuck with the band to mastermind their greatest work, including Pet Sounds and the 'Good Vibrations' single.

Brian Wilson's Email Addresses

People you may be

interested in

American media personality

American activist and writer

South African actress and singer

American actor and model

Football running back

Member of the Chamber of Deputies of Chile

American actor

English actor

American actress

Author

American musician

American actor