Amy Lee's Email & Phone Number

American singer-songwriter and musician

Amy Lee's Email Addresses

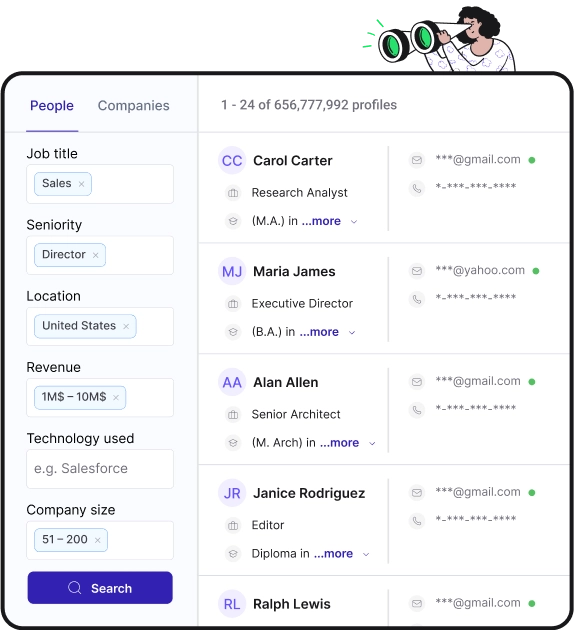

Find personal and work emails for over 300M professionals

Not the Amy Lee you were looking for? Continue your search below:About Amy Lee

📖 Summary

Amy Lee is an American singer-songwriter and musician best known as the lead vocalist and co-founder of the rock band Evanescence. Born on December 13, 1981, in Riverside, California, she showed an extraordinary talent for music from a young age. With her hauntingly powerful vocals, Lee quickly captivated audiences around the world, establishing herself as one of the most influential female rock musicians of her generation.

Growing up in a musical family, Amy Lee began taking piano lessons at the age of six. This early introduction to music became the foundation for her future success. Although the piano was her first instrument, Lee's incredible vocal range soon became her most prominent feature. Her hauntingly beautiful voice effortlessly blends elements of rock, gothic, and classical music to create a truly unique sound that stands out in the industry.

In 2003, Evanescence burst onto the music scene with their multi-platinum debut album, "Fallen." The album featured iconic tracks such as "Bring Me to Life" and "My Immortal," catapulting the band to worldwide fame and earning numerous awards, including two Grammy Awards. Amy Lee's soaring vocals and emotionally charged lyrics were the driving force behind the album's success, resonating with audiences across all genres.

After the massive success of "Fallen," Amy Lee continued to showcase her immense talent by collaborating with various artists and exploring different musical styles. She contributed to the soundtracks of blockbuster movies like "Underworld" and "The Nightmare Before Christmas," showcasing her versatility and willingness to push boundaries. Lee's collaborations demonstrated her ability to adapt her vocal style to fit a vast range of genres, solidifying her reputation as a true musical chameleon.

In 2007, Evanescence released their highly anticipated album, "The Open Door." Once again, Amy Lee's vocals shone, with tracks such as "Call Me When You're Sober" and "Lithium" captivating fans and critics alike. The album debuted at number one on the Billboard charts and showcased the band's evolution and growth since their debut. Lee's raw and powerful delivery continued to be the highlight of Evanescence's sound, cementing her status as a rock icon.

Throughout her career, Amy Lee has never been afraid to take risks and explore new musical territory. In 2011, she released her first solo single, "Sally's Song," a cover from "The Nightmare Before Christmas." This marked a new chapter in her career, allowing her to experiment with different styles and showcase her skills as a songwriter and musician outside the confines of a band setting.

In 2017, Evanescence released their fourth studio album, "Synthesis," which featured reimagined versions of their classic songs accompanied by a full symphony orchestra. This ambitious project once again showcased Amy Lee's ability to push boundaries and create something completely unique and breathtaking. Her collaboration with the orchestra added a new dimension to the music, highlighting her ability to adapt her voice to different musical arrangements.

Amy Lee's impact on the music industry cannot be overstated. Her powerful vocals, emotive performances, and unwavering dedication to her craft have solidified her as one of the greatest rock musicians of her generation. Beyond her musical achievements, she is also known for her activism and philanthropy, using her platform to advocate for various causes.

In conclusion, Amy Lee is a true musical force to be reckoned with. As a singer-songwriter and musician, she has shown immense talent and versatility throughout her career, captivating audiences with her hauntingly beautiful vocals and emotionally charged lyrics. Whether as the frontwoman of Evanescence or as a solo artist, Amy Lee continues to push boundaries and create music that resonates with millions around the world. Her impact on the industry will be felt for years to come, solidifying her status as a trailblazer and inspiration for aspiring musicians.

Frequently Asked Questions about Amy Lee

Is Amy from Evanescence married?

Josh Hartzler Evanescence singer Amy Lee was married on May 6, her rep confirms to PEOPLE. Lee, 25, married Josh Hartzler, a 29-year-old New York City-based therapist, at her family's home in Little Rock, Ark., the Arkansas Democrat-Gazette reported Wednesday.

What happened to Evanescence?

Following the end of the album's tour cycle, the band entered a hiatus. In 2014, Lee and Evanescence left their record label and became independent artists. The band emerged from hiatus in 2015 and resumed touring, while a new album was not yet created as Lee was also focusing on a solo project.

Does Amy Lee and Evanescence have any children?

Jack Lion Hartzler Amy Lee / Children

How old was Amy Lee in Evanescence?

41 years (December 13, 1981) Amy Lee / Age

Amy Lee's Email Addresses

People you may be

interested in

American actor and comedian

Journalist

Barack Obama's daughter

American singer and dancer

Belgian vlogger and radio presenter

American actress

Malaysian actress

Canadian ice hockey centre

American actress

Freelance Writer

Building lasting and valuable companies.

Executive Editor, National League at Major League Baseball