Richard Hudson's Email & Phone Number

United States Representative

Richard Hudson's Email Addresses

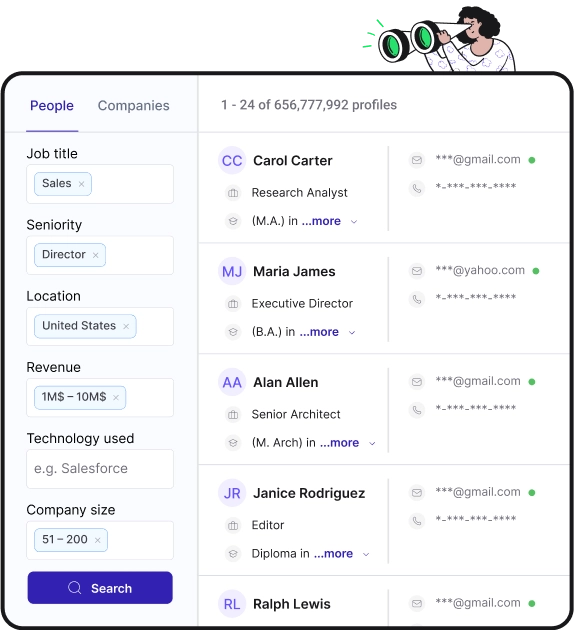

Find personal and work emails for over 300M professionals

Not the Richard Hudson you were looking for? Continue your search below:About Richard Hudson

📖 Summary

Richard Hudson is a seasoned United States Representative serving North Carolina’s 8th congressional district. As a dedicated public servant, he has effectively represented his constituents since taking office in 2013. With a background in business and a passion for policy-making, Hudson has established himself as a steadfast advocate for conservative values and economic growth.

Hudson’s commitment to improving the lives of North Carolinians has been evident throughout his career in Congress. He has consistently worked towards implementing policies that foster job creation, support small businesses, and strengthen the local economy. As a member of the influential House Energy and Commerce Committee, Hudson has been instrumental in shaping legislation that addresses critical issues such as healthcare, energy, and telecommunications. His proactive approach and strong leadership have earned him the respect of his colleagues and the trust of his constituents.

In addition to his contributions to economic development, Hudson has been a vocal champion for veterans’ rights and national security. Recognizing the sacrifices made by the brave men and women in uniform, he has been a staunch advocate for policies that support and honor our nation’s veterans. Furthermore, Hudson has been an ardent supporter of bolstering our military capabilities and ensuring the safety and security of the United States. His unwavering dedication to these vital issues demonstrates his deep-rooted commitment to serving the nation and protecting its interests.

Hudson’s unwavering dedication to serving the people of North Carolina is further demonstrated through his approachability and willingness to engage with constituents. He places a high value on listening to the concerns and feedback of those he serves, and makes it a priority to stay connected with the community. By hosting town hall meetings, conducting outreach initiatives, and actively seeking input from his constituents, Hudson has fostered an open and transparent dialogue that allows him to effectively represent their interests in Congress. This strong connection with the people he serves has strengthened his ability to address their needs and ensure their voices are heard in the legislative process.

As a committed public servant, Richard Hudson has consistently demonstrated his ability to navigate the complexities of policymaking and deliver measurable results for the people of his district. His dedication to advancing conservative principles, advocating for economic growth, and championing the rights of veterans has set him apart as a leader in Congress. Through his collaborative approach, strong principles, and tireless work ethic, Hudson has proven himself as a steadfast representative who prioritizes the needs of his constituents and is dedicated to making a positive impact in their lives. As he continues to serve in the United States House of Representatives, Hudson’s unwavering commitment to the well-being of North Carolinians and the nation at large remains steadfast, making him a respected and effective leader in Congress.

Frequently Asked Questions about Richard Hudson

What is Richard Hudson known for?

Richard Lane Hudson Jr. (born November 4, 1971) is an American politician serving as the U.S. representative for North Carolina's 9th congressional district since 2013 (previously numbered the 8th district).

Is Richard Hudson a Republican?

Republican Party

Who is the Hudson senator for North Carolina?

Richard Hudson has served in Congress since 2013, currently representing North Carolina's 9th Congressional District.

Who is the congressman for Chatham County NC?

US Congressional District 9 - Richard Hudson (Rep)

Richard Hudson's Email Addresses

People you may be

interested in

United States Representative

United States Representative

United States Representative

State Regional Manager--Owner, LegalShield legal services

CAD/CAM Drafting Manager at Gordon Incorporated

CEO of Little City Foundation, Former Congresswoman, Board Member for The Institute on Public Policy for People with Disabilities, Speaker and Author, focused on disability rights, healthcare, and equ

Global Account Manager at GTT - Helping Enterprise Businesses securely connect around the world!

Regional Strategic Sourcing Manager

Marketing Mid Office Manager at Marathon Oil Corporation

United States Representative

Certified ReEntry Professional at Justice Reinvestment Group of NC

Politician