Marc Sharpe's Email & Phone Number

Family Office | Private Equity | Venture Capital

Marc Sharpe Email Addresses

Marc Sharpe Phone Numbers

Marc Sharpe's Work Experience

The Family Office Association

Founder & Chairman

January 2007 to Present

IVY EB5

Chief Executive Officer

February 2016 to May 2022

Private Investment Firm

Managing Director

July 2013 to December 2015

SigmaBleyzer Private Equity

Executive Director

August 2009 to July 2013

Galapagos Partners, L.P.

Portfolio Manager

August 2006 to July 2009

Dell, Inc.

Strategic Business Manager

October 2001 to January 2005

Protege Group

Vice President

July 1999 to August 2001

LJH Global Investments

Vice President

January 1998 to January 1999

Wasserstein Perella

Financial Analyst

June 1994 to July 1996

Show more

Show less

Frequently Asked Questions about Marc Sharpe

What is Marc Sharpe email address?

Email Marc Sharpe at [email protected], [email protected] and [email protected]. This email is the most updated Marc Sharpe's email found in 2024.

How to contact Marc Sharpe?

To contact Marc Sharpe send an email to [email protected], [email protected] or [email protected].

What company does Marc Sharpe work for?

Marc Sharpe works for The Family Office Association

What is Marc Sharpe's role at The Family Office Association?

Marc Sharpe is Founder & Chairman

What is Marc Sharpe's Phone Number?

Marc Sharpe's phone (214) ***-*304

What industry does Marc Sharpe work in?

Marc Sharpe works in the Financial Services industry.

Marc Sharpe's Professional Skills Radar Chart

Based on our findings, Marc Sharpe is ...

What's on Marc Sharpe's mind?

Based on our findings, Marc Sharpe is ...

Marc Sharpe's Estimated Salary Range

Marc Sharpe Email Addresses

Marc Sharpe Phone Numbers

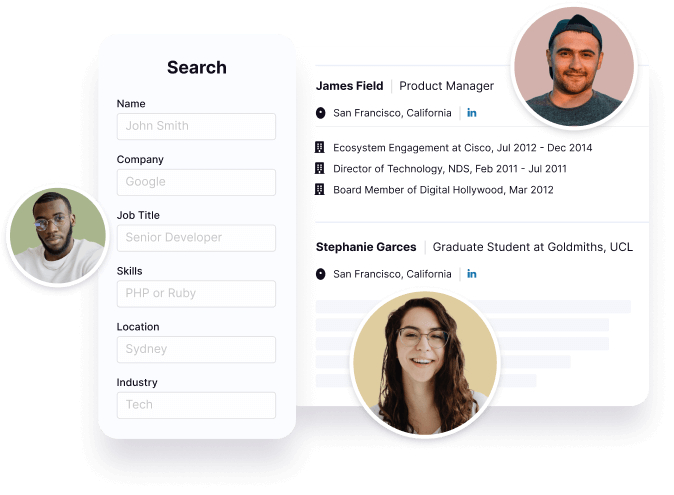

Find emails and phone numbers for 300M professionals.

Search by name, job titles, seniority, skills, location, company name, industry, company size, revenue, and other 20+ data points to reach the right people you need. Get triple-verified contact details in one-click.In a nutshell

Marc Sharpe's Ranking

Ranked #761 out of 15,228 for Founder & Chairman in Texas

Marc Sharpe's Personality Type

Extraversion (E), Intuition (N), Feeling (F), Judging (J)

Average Tenure

2 year(s), 0 month(s)

Marc Sharpe's Willingness to Change Jobs

Unlikely

Likely

Open to opportunity?

There's 77% chance that Marc Sharpe is seeking for new opportunities

Top Searched People

Erotic photography model

Mexican-American canine professional

American professional wrestler and model

American music video director

Puerto Rican singer and actress

Marc Sharpe's Social Media Links

/in/sharpemarc /company/tfoa /school/harvard-business-school/ /redir/redirect