Joel Campbell's Email & Phone Number

Costa Rican soccer player

Joel Campbell's Email Addresses

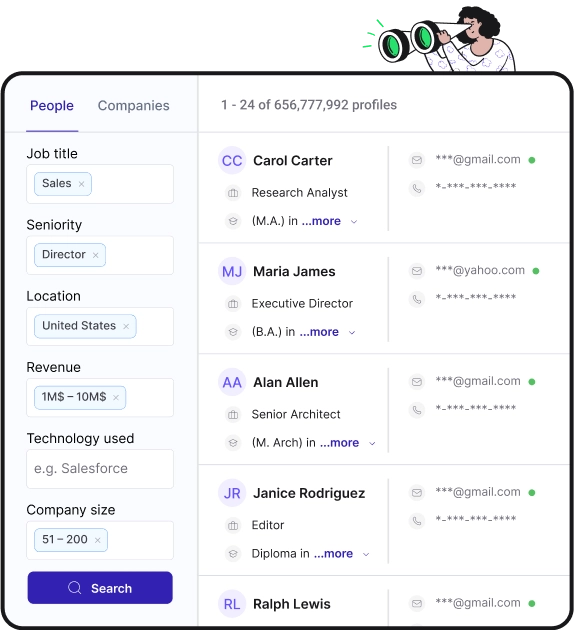

Find personal and work emails for over 300M professionals

Not the Joel Campbell you were looking for? Continue your search below:About Joel Campbell

📖 Summary

Joel Campbell is a Costa Rican soccer player who has made a name for himself on both the domestic and international stage. Born on June 26, 1992, in San José, Costa Rica, Campbell's passion for soccer was evident from a young age. He joined the youth system of Costa Rican club Deportivo Saprissa and quickly rose through the ranks to make his professional debut for the senior team at just 16 years old.

Campbell's talent and potential were impossible to ignore, and he eventually caught the eye of European scouts. In 2011, he made the move to the Dutch club FC Twente, where he continued to develop his skills and showcase his ability to score goals and create opportunities for his teammates. His performances at Twente did not go unnoticed, and soon after, he was signed by English Premier League side Arsenal FC.

It was at Arsenal where Campbell truly began to make a name for himself on the international stage. His electrifying pace, quick footwork, and eye for goal made him a fan favorite, and he quickly became an integral part of the team. During his time at Arsenal, Campbell also went out on loan to various clubs in Europe, including Real Betis in Spain, Olympiacos in Greece, and Sporting CP in Portugal. Despite the challenges of adapting to new leagues and styles of play, Campbell continued to impress with his versatility and ability to make an impact wherever he went.

Campbell's success at the club level translated to his performances with the Costa Rican national team. He made his senior debut for Los Ticos in 2011 and has been a key player for his country ever since. One of the highlights of his international career came during the 2014 FIFA World Cup in Brazil, where he scored a memorable goal against Uruguay in the group stage. His performance at the tournament drew widespread praise and put him on the radar of even more top European clubs.

In 2016, Campbell joined Portuguese powerhouse Sporting CP on a permanent basis, eager to continue his development and help the team achieve success in domestic and European competitions. His time at Sporting allowed him to further refine his skills and gain valuable experience at a high level of competition. He continued to make important contributions on the field, scoring goals and providing assists to help his team win matches and compete for titles.

After his stint at Sporting, Campbell went on loan to several other clubs, including Villarreal in Spain, where he continued to showcase his talent and make a positive impact. His ability to adapt to different playing styles and environments demonstrated his versatility and determination to succeed. Despite facing challenges and setbacks along the way, Campbell's passion for the game and desire to excel never wavered.

In 2020, Campbell returned to his native Costa Rica to join Liga Deportiva Alajuelense, a move that allowed him to play an instrumental role in the team's pursuit of domestic glory. His experience and leadership proved valuable to his new club, as he helped guide them to victory in the Costa Rican Primera División. Campbell's return to Costa Rica also provided him with the opportunity to give back to the community that had supported him throughout his career, serving as an inspiration to aspiring young soccer players in his home country.

Campbell's journey as a professional soccer player has been filled with ups and downs, but his unwavering passion for the game and determination to succeed have propelled him to achieve great things. His talent, skill, and versatility have made him a valuable asset to every team he has played for, and his contributions on the field have earned him the respect and admiration of fans and peers alike. As he continues to pursue his soccer career, Campbell remains a shining example of perseverance and dedication, proving that with hard work and dedication, anything is possible on and off the field.

Frequently Asked Questions about Joel Campbell

How old is J Campbell?

31 years (June 26, 1992)

Who is the Arsenal player called Campbell?

Kevin Campbell | Players | Men | Arsenal.com.

How tall was Sol Campbell?

6′ 2″

What team did Sol Campbell play for?

Former Professional Footballer Sulzeer Jeremiah “Sol” Campbell is a retired English footballer, best known for his position as a central defender and for captaining the England Squad. Sol has played for Tottenham Hotspur, Arsenal, Portsmouth and Newcastle United, and represented his country in the sport.

Joel Campbell's Email Addresses

People you may be

interested in

American singer-songwriter

American actress and talk show host

Essentials Delivery Manager

CEO at Cove Group

McDonald Humphrey, LLP

Construction Manager at Lennar

Director, Media Operations at Barkley & Youth Soccer Coach at Sporting City North, a Sporting Kansas City Club

CEO of Fanatics

Experience Design Director, ASEAN at Concentrix Tigerspike

Professional Football Player at Chelsea FC

Model ‧ Keylor Navas' wife

Costa Rican soccer player