Dylan Riley's Email & Phone Number

VP Finance at Demodesk

Dylan Riley Email Addresses

Dylan Riley Phone Numbers

Dylan Riley's Work Experience

NYU Venture Community

Board Member

February 2013 to Present

Blackmoon Financial Group

VP, Head of Operations

July 2016 to June 2017

NVNG Management Inc.

Contract Associate

August 2013 to September 2013

Anvil Advisors

Associate

July 2013 to September 2013

Anvil Advisors

Financial Analyst

May 2012 to June 2013

Pavilion Capital Partners

Private Equity Summer Analyst

June 2011 to September 2011

Show more

Show less

Dylan Riley's Education

New York University - Leonard N. Stern School of Business

January 2008 to January 2011

Boston University

January 2007 to January 2008

Boston University - School of Management

January 2007 to January 2008

Show more

Show less

Frequently Asked Questions about Dylan Riley

What is Dylan Riley email address?

Email Dylan Riley at [email protected]. This email is the most updated Dylan Riley's email found in 2024.

What is Dylan Riley phone number?

Dylan Riley phone number is (262)909-6280.

How to contact Dylan Riley?

To contact Dylan Riley send an email to [email protected]. If you want to call Dylan Riley try calling on (262)909-6280.

What company does Dylan Riley work for?

Dylan Riley works for Demodesk

What is Dylan Riley's role at Demodesk?

Dylan Riley is VP of Finance

What industry does Dylan Riley work in?

Dylan Riley works in the Computer Software industry.

Dylan Riley's Professional Skills Radar Chart

Based on our findings, Dylan Riley is ...

What's on Dylan Riley's mind?

Based on our findings, Dylan Riley is ...

Dylan Riley's Estimated Salary Range

Dylan Riley Email Addresses

Dylan Riley Phone Numbers

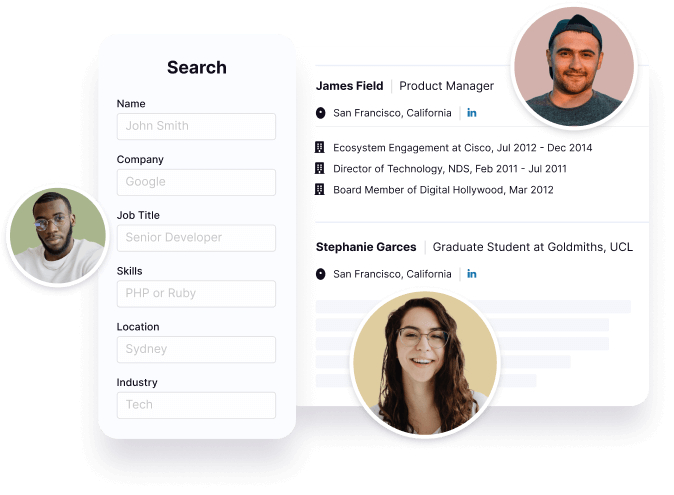

Find emails and phone numbers for 300M professionals.

Search by name, job titles, seniority, skills, location, company name, industry, company size, revenue, and other 20+ data points to reach the right people you need. Get triple-verified contact details in one-click.In a nutshell

Dylan Riley's Personality Type

Introversion (I), Intuition (N), Thinking (T), Judging (J)

Average Tenure

2 year(s), 0 month(s)

Dylan Riley's Willingness to Change Jobs

Unlikely

Likely

Open to opportunity?

There's 92% chance that Dylan Riley is seeking for new opportunities

Dylan Riley's Social Media Links

/in/dylanriley