Christopher Hohn's Email & Phone Number

British manager

Christopher Hohn's Email Addresses

Christopher Hohn's Phone Numbers

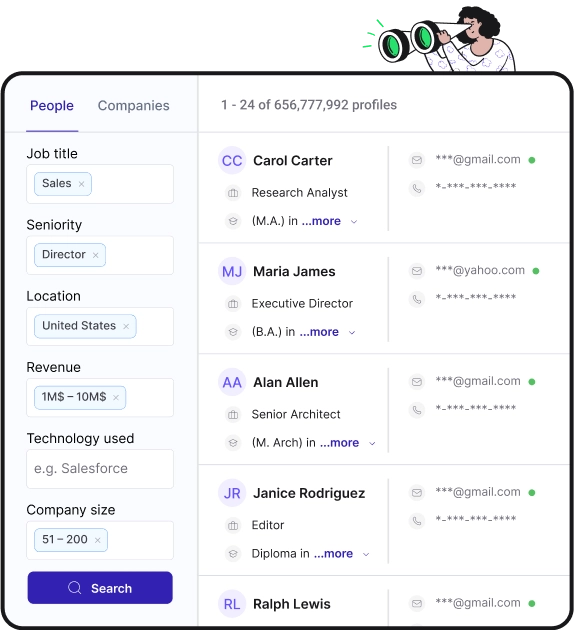

Find personal and work emails for over 300M professionals

Not the Christopher Hohn you were looking for? Continue your search below:About Christopher Hohn

📖 Summary

Christopher Hohn is a prominent British hedge fund manager known for his bold activist investment strategies and philanthropic efforts. Born in 1966 in Addlestone, Surrey, Hohn attended the prestigious Southampton University, where he earned a degree in accounting and business. Following his education, Hohn began his career in finance, working as an analyst for investment bank Credit Suisse First Boston and then for private equity firm Apax Partners. However, it wasn't until he founded the hedge fund The Children's Investment Fund (TCI) in 2003 that Hohn truly made a name for himself in the financial world.

At TCI, Hohn quickly gained a reputation for his aggressive activism and shrewd investment tactics. He has been credited with shaking up management at companies such as ABN Amro, Deutsche Börse, and CSX Corporation, often taking on entrenched board members and pushing for structural changes to maximize shareholder value. Hohn's approach has not only garnered attention but has also resulted in impressive returns for TCI's investors. In fact, according to Bloomberg, TCI's Master Fund has delivered an annualized return of over 18% since its inception, outperforming many of its peers and solidifying Hohn's status as a major player in the hedge fund industry.

In addition to his success in finance, Hohn is also known for his philanthropy and advocacy for social and environmental issues. Through his charitable organization, the Children's Investment Fund Foundation (CIFF), Hohn has donated billions of dollars to causes such as combating climate change, improving education, and supporting children's rights. His commitment to philanthropy has earned him praise from world leaders and organizations, and in 2015, he was appointed Knight Commander of the Order of St. Michael and St. George for his services to philanthropy and international development.

Hohn's impact extends beyond the financial and philanthropic realms. His activism on issues such as executive pay and climate change has sparked discussions and prompted change within the corporate world. In 2019, for example, TCI played a key role in pressuring companies to disclose their carbon emissions and align their business strategies with the goals of the Paris Agreement. Similarly, Hohn has been vocal about the need for transparency and accountability in corporate governance, calling for reforms to address issues such as excessive executive compensation and lack of diversity on boards.

As an individual, Hohn is known for his steely determination and unwavering commitment to his principles. He is often described as relentless in his pursuit of corporate change and unafraid to challenge the status quo. His bold and direct approach has earned him both admirers and critics, with some hailing him as a champion for shareholder rights and others criticizing him for his aggressive tactics. Nevertheless, there is no denying Hohn's influence and impact on the financial and social landscape.

In conclusion, Christopher Hohn is a British manager whose career has been defined by his bold activism, sharp investment acumen, and profound philanthropy. His accomplishments in finance, coupled with his dedication to social and environmental causes, have solidified his reputation as a leading figure in both the financial and philanthropic sectors. Hohn's impact extends beyond the boardroom, as his advocacy and leadership have sparked discussions, prompted change, and inspired others to take action. Whether challenging corporate governance practices or addressing global challenges, Christopher Hohn continues to make a significant mark on the world around him.

Frequently Asked Questions about Christopher Hohn

How did Chris Hohn make his money?

In 1996 he went to work for Perry Capital, a hedge fund on Wall Street. In 1998 he was made head of Perry's London operations. In his time with Perry, he earned an estimated £75m. In 2003, Hohn set up his own hedge fund, The Children's Investment Fund.

Which hedge fund billionaire Sir Chris Hohn paid himself 1.5 Ma day this year?

The billionaire hedge fund manager Sir Chris Hohn paid himself a record-breaking $690m (£574m) this year after his Children's Investment (TCI) fund recorded a a surge in profits.Nov 30, 2022

How much does TCI fund charge?

The Children's Investment Fund Management charges investors a management fee of approximately 2% and takes 20% of the profits made by the investment.

How big is the TCI fund?

US$ 36.2 billion

Christopher Hohn's Email Addresses

Christopher Hohn's Phone Numbers

People you may be

interested in

Gamer

South African social entrepreneur

Filipino actress

American businesswoman and fashion designer

American actress and comedian

American reporter

American actress and model

American actress and dancer

American musical artist

Canadian-American actress

American actress

American businessman