Chris Kirkness's Email & Phone Number

Chairman of Private Equity at Korn/Ferry Whitehead Mann

Chris Kirkness Email Addresses

Chris Kirkness Phone Numbers

Chris Kirkness's Work Experience

Korn/Ferry|Whitehead Mann

Senior Client Partner, Chairman of Private Equity EMEA

Breathing Buildings Limited

Non-Executive Director

Syndicate Member

ABN AMRO

Managing Director, Global Head of Financial Sponsors Group

Director, Corporate Finance

UBS

Managing Director, Corporate Finance

Kleinwort Benson

Director, Corporate Finance

Touche Ross

Supervisor

Show more

Show less

Chris Kirkness's Education

Imperial College London

BSc (Hons) Civil Engineering

Show more

Show less

Frequently Asked Questions about Chris Kirkness

What company does Chris Kirkness work for?

Chris Kirkness works for Korn/Ferry|Whitehead Mann

What is Chris Kirkness's role at Korn/Ferry|Whitehead Mann?

Chris Kirkness is Senior Client Partner, Chairman of Private Equity EMEA

What is Chris Kirkness's personal email address?

Chris Kirkness's personal email address is c****[email protected]

What is Chris Kirkness's business email address?

Chris Kirkness's business email address is c****[email protected]

What is Chris Kirkness's Phone Number?

Chris Kirkness's phone +44 ** **** *490

What industry does Chris Kirkness work in?

Chris Kirkness works in the Venture Capital & Private Equity industry.

Chris Kirkness's Professional Skills Radar Chart

Based on our findings, Chris Kirkness is ...

What's on Chris Kirkness's mind?

Based on our findings, Chris Kirkness is ...

Chris Kirkness's Estimated Salary Range

Chris Kirkness Email Addresses

Chris Kirkness Phone Numbers

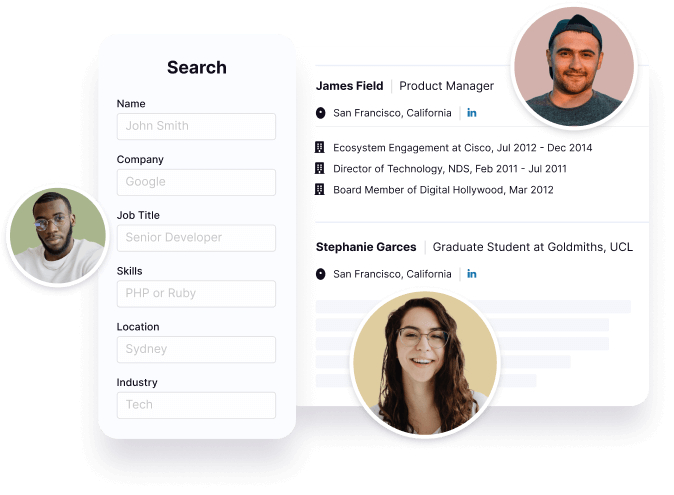

Find emails and phone numbers for 300M professionals.

Search by name, job titles, seniority, skills, location, company name, industry, company size, revenue, and other 20+ data points to reach the right people you need. Get triple-verified contact details in one-click.In a nutshell

Chris Kirkness's Personality Type

Introversion (I), Intuition (N), Thinking (T), Judging (J)

Average Tenure

2 year(s), 0 month(s)

Chris Kirkness's Willingness to Change Jobs

Unlikely

Likely

Open to opportunity?

There's 91% chance that Chris Kirkness is seeking for new opportunities

Top Searched People

Dick Cheney's daughter

American actress and comedian

English soccer goalkeeper

Canadian television host and author

American political assistant

Chris Kirkness's Social Media Links

/in/christopher-kirkness-8668b712